Company

Structure

Aroundtown SA is a real estate company with a focus on income generating quality properties with value-add potential in central locations in top tier European cities primarily in Germany, the Netherlands and London.

Aroundtown invests in commercial and residential real estate which benefits from strong fundamentals and growth prospects. Aroundtown invests in residential real estate through its subsidiary Grand City Properties S.A. ("GCP"), a publicly traded real estate company that focuses on investing in value-add opportunities predominantly in the German residential real estate market.

Business model

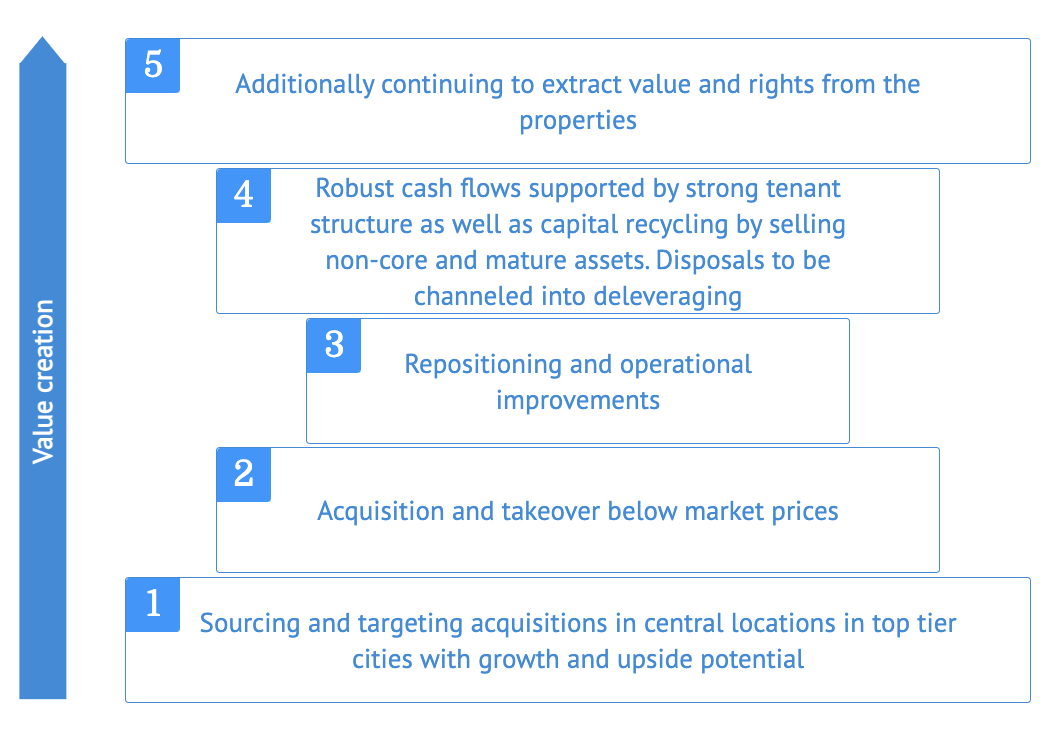

Operating with a fully integrated real estate value chain Aroundtown targets value creation opportunities from repositioning properties. Aroundtown picks quality cash generating properties with upside potential in rent and/or occupancy increase and consequential value. Through an intensive property management, including operational and repositioning activities, Aroundtown further improves the portfolio results, creating secure and strong cash flow generating characteristics and great internalized growth potential.

Strategy

Aroundtown’s strategy is centered around its main pillars and continuously improving upon operational and financial metrics, with a centrally located portfolio in top tier cities.