Rating

| Rating Agency | Rating Type | Rating | Outlook |

|---|---|---|---|

| S&P | long term rating |

BBB |

Stable |

| S&P | short term rating | A-2 | |

| S&P Maalot | long term rating |

ilAA |

Stable |

| S&P Maalot | short term rating | ilA-1+ |

Credit Rating reports

Financial Policy

- LTV guidance below 45% on a sustainable basis

- Debt to debt-plus-equity ratio at 45% (or lower) on a sustainable basis

- Maintaining conservative financial ratios with a strong ICR

- Unencumbered assets above 50% of total assets

- Long debt maturity profile

- Good mix of long term unsecured bonds and bank loans

- Dividend of 75% of FFO I per share*

* subject to market conditions

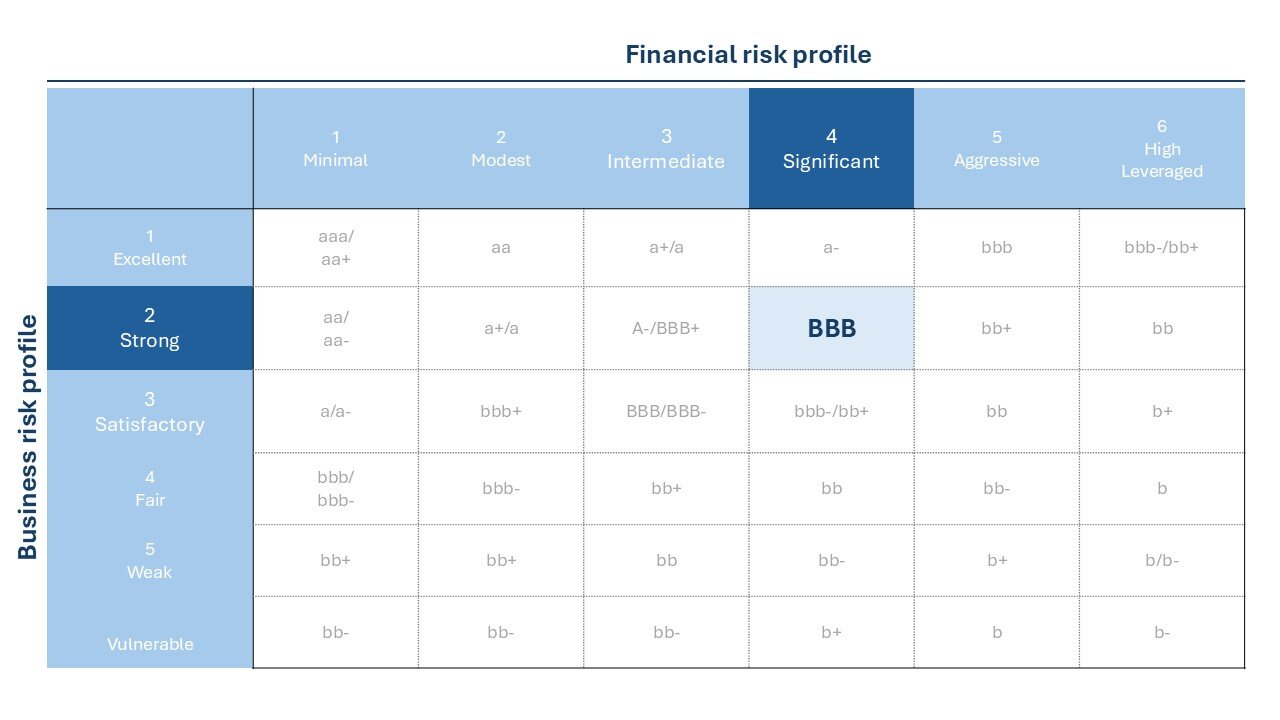

S&P Anchor Rating Matrix